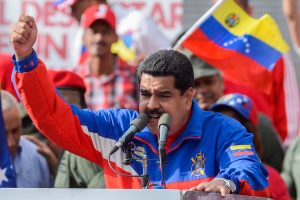

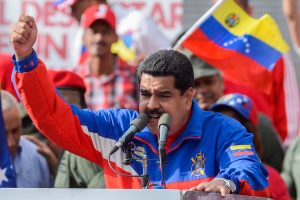

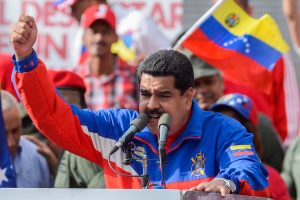

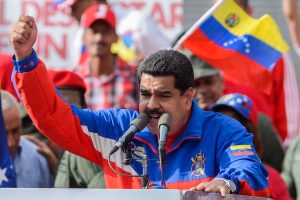

Concerns around insider war trading are being raised after a Polymarket bet on the Venezuelan President Nicolas Maduro results in a $400,000 cashout.

As pointed out by investor and podcaster Joe Pompliano on X, a brand-new Polymarket account invested more than $30,000 on January 2 in a bet that Maduro would leave power in Venezuela by January 31, 2026. Shortly after, the US then took him into custody that very night, meaning the trader made over $400,000 in less than 24 hours.

“Insider trading is not only allowed on prediction markets; it’s encouraged,” wrote Pompliano.

A newly created Polymarket account invested over $30,000 yesterday in Maduro's exit. The US then took Maduro into custody overnight, and the trader profited $400,000 in less than 24 hours. Insider trading is not only allowed on prediction markets; it's encouraged. https://t.co/EtZyW1IWTa pic.twitter.com/MzsU9kOU73

— Joe Pompliano (@JoePompliano) January 3, 2026

While there’s no evidence that the anonymous account is connected to someone with insider information about the planned move from American forces, it raises concerns about the lack of restrictions around insider trading on prediction markets. This legal gap could soon be plugged, with New York Congressman Ritchie Torres introducing the Public Integrity in Financial Prediction Markets Act of 2026, as reported by Punch Bowl News’ Jake Sherman.

A legal loophole that needs regulation

This bill seeks to block federal elected officials, political appointees, and Executive Branch employees from taking part in certain prediction market transactions that involve bets where they either possess insider information relevant to the outcome or could reasonably obtain such information through their official roles. The restriction would apply to buying, selling, or exchanging prediction market contracts related to government policy, government action, or political outcomes.

We’ve already seen examples of how prediction markets could be abused when it comes to people in positions of power or with insider information, although on a smaller scale, when Coinbase CEO Brian Armstrong showed how business leaders could feasibly profit from contracts on their actions. Naturally, this potential becomes still more concerning when the stakes concern global politics, rather than business outcomes.

ReadWrite has reached out to Polymarket for comment.

Featured image: Flickr, licensed under CC BY-NC 2.0

The post Polymarket Maduro bet resulting in $400,000 cashout sparks concerns of insider trading appeared first on ReadWrite.